All Categories

Featured

Table of Contents

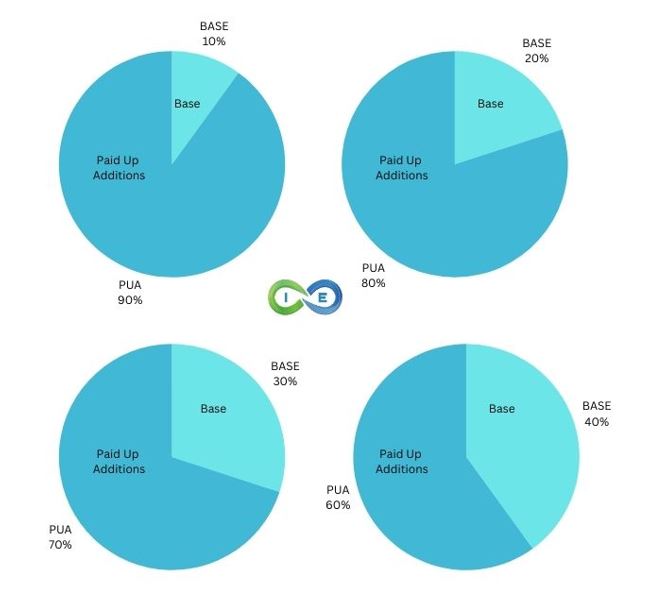

A PUAR allows you to "overfund" your insurance policy right up to line of it ending up being a Customized Endowment Contract (MEC). When you utilize a PUAR, you rapidly boost your cash value (and your fatality benefit), consequently boosting the power of your "bank". Better, the even more money value you have, the better your passion and returns settlements from your insurance coverage business will be.

With the increase of TikTok as an information-sharing system, financial advice and methods have discovered an unique way of spreading. One such technique that has actually been making the rounds is the boundless financial principle, or IBC for short, amassing recommendations from celebs like rap artist Waka Flocka Flame. Nevertheless, while the technique is currently popular, its roots map back to the 1980s when economic expert Nelson Nash presented it to the globe.

How can Financial Leverage With Infinite Banking reduce my reliance on banks?

Within these policies, the money worth grows based upon a rate set by the insurer (Infinite Banking). Once a considerable money worth gathers, policyholders can obtain a money worth finance. These car loans differ from standard ones, with life insurance policy offering as security, meaning one could lose their insurance coverage if loaning exceedingly without sufficient money value to sustain the insurance expenses

And while the allure of these policies is evident, there are inherent limitations and dangers, requiring diligent cash money value tracking. The strategy's legitimacy isn't black and white. For high-net-worth individuals or entrepreneur, specifically those utilizing techniques like company-owned life insurance policy (COLI), the advantages of tax obligation breaks and compound growth might be appealing.

The attraction of unlimited banking does not negate its difficulties: Expense: The foundational requirement, a long-term life insurance policy plan, is more expensive than its term equivalents. Eligibility: Not everyone gets approved for whole life insurance as a result of rigorous underwriting procedures that can omit those with particular health and wellness or way of life problems. Complexity and danger: The elaborate nature of IBC, paired with its risks, may hinder numerous, especially when easier and less risky options are offered.

What are the tax advantages of Financial Leverage With Infinite Banking?

Allocating around 10% of your regular monthly income to the plan is simply not possible for a lot of individuals. Using life insurance as an investment and liquidity source needs self-control and surveillance of plan money value. Get in touch with a financial advisor to determine if limitless banking aligns with your concerns. Component of what you review below is simply a reiteration of what has already been stated above.

So prior to you obtain into a scenario you're not gotten ready for, understand the following first: Although the idea is commonly marketed as such, you're not in fact taking a loan from yourself. If that were the situation, you wouldn't need to repay it. Instead, you're borrowing from the insurance firm and have to settle it with passion.

Some social media sites messages suggest making use of cash money worth from entire life insurance policy to pay down bank card debt. The concept is that when you settle the funding with interest, the quantity will be returned to your financial investments. However, that's not exactly how it functions. When you repay the car loan, a portion of that passion mosts likely to the insurance provider.

For the very first a number of years, you'll be paying off the compensation. This makes it extremely challenging for your plan to collect value during this time. Unless you can manage to pay a few to a number of hundred bucks for the next years or more, IBC will not work for you.

What are the common mistakes people make with Self-financing With Life Insurance?

Not everybody must depend solely on themselves for monetary safety. If you need life insurance coverage, below are some useful suggestions to think about: Think about term life insurance policy. These policies give coverage throughout years with significant economic responsibilities, like mortgages, student financings, or when taking care of little ones. Make certain to search for the very best price.

Picture never ever needing to bother with financial institution financings or high interest rates once again. What happens if you could borrow money on your terms and build wide range concurrently? That's the power of boundless banking life insurance policy. By leveraging the money worth of whole life insurance policy IUL policies, you can grow your wide range and borrow cash without depending on conventional banks.

There's no set loan term, and you have the flexibility to pick the settlement routine, which can be as leisurely as paying back the car loan at the time of death. Infinite Banking benefits. This flexibility reaches the maintenance of the car loans, where you can select interest-only payments, maintaining the funding balance flat and manageable

Holding money in an IUL fixed account being credited interest can often be much better than holding the cash on deposit at a bank.: You've constantly dreamed of opening your own bakeshop. You can obtain from your IUL plan to cover the first expenses of leasing a room, buying tools, and hiring personnel.

How do I optimize my cash flow with Infinite Banking For Retirement?

Individual car loans can be acquired from standard financial institutions and lending institution. Here are some crucial factors to think about. Bank card can give a versatile way to borrow cash for extremely short-term durations. Nevertheless, borrowing money on a debt card is usually really costly with interest rate of interest (APR) commonly getting to 20% to 30% or even more a year - Self-banking system.

Table of Contents

Latest Posts

How To Become Your Own Bank

Infinite Banking Simplified

How To Become My Own Bank

More

Latest Posts

How To Become Your Own Bank

Infinite Banking Simplified

How To Become My Own Bank